How to Fill out an Ontario Automobile Proof of Loss Form

If you’ve ever had an auto insurance claim in Ontario, you may have received a proof of loss form to complete. This article will explain what a Proof of Loss form is and its purpose in the auto claims adjudication process.

What is a proof of loss form?

Insurance companies use a Proof of Loss form to obtain a formal declaration of the damages being claimed. Think of it as a type of affidavit, or sworn statement, wherein you declare to the insurance company the details surrounding the loss and how much you are claiming. You would also need to have your signature legally, witnessed by a notary public or a Commissioner of Oaths if your insurance company requires it.

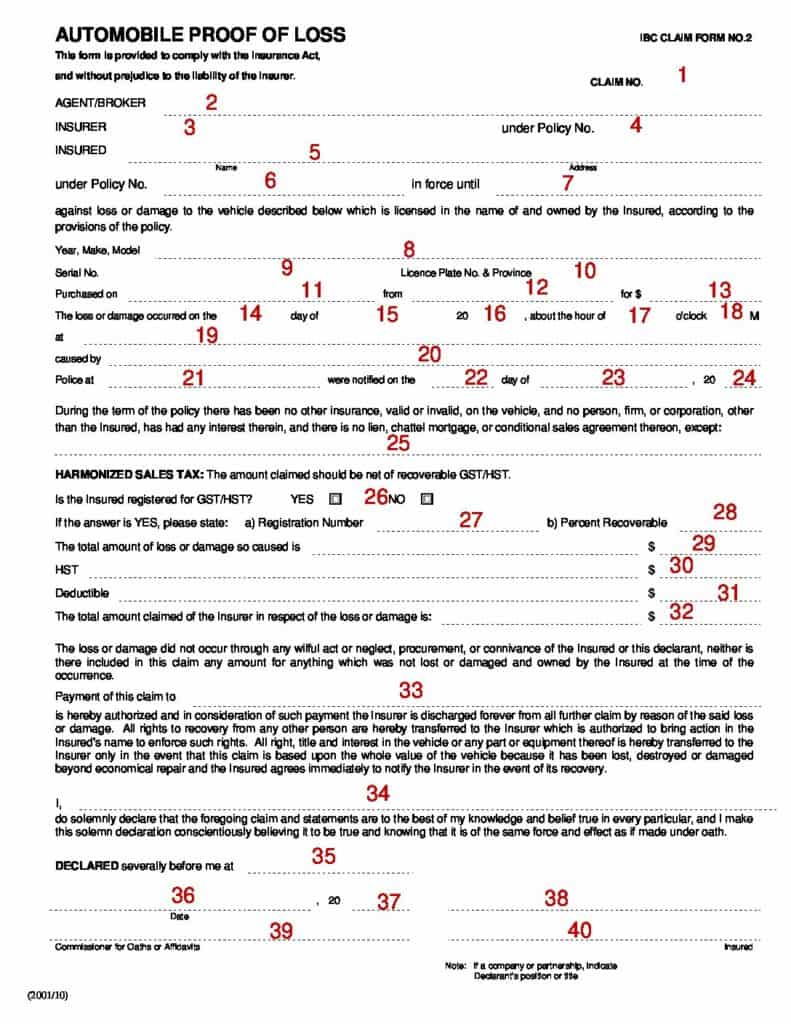

How to fill out a proof of loss form:

- Add your claim number

- Write down your insurance agent or broker (not to be confused with your insurance carrier)

- Write down your insurance carrier

- Write down your policy number

- Put your name or company name here

- Place your policy number here, again

- The date when your policy expires

- Year, make and model of vehicle

- Vehicle VIN or serial number goes here

- License plate and province

- Date when you purchased the vehicle

- Where you purchase the vehicle from

- The amount you purchased your vehicle for

- Day of the loss

- Month of loss

- Year of the loss

- Time of the loss

- Did the loss happen in the AM or PM

- Where the loss happened. For example what street, city and province

- What was the insured peril? i.e. theft, fire, collision

- Name of a police agency

- The day the police were notified

- The month when police were notified

- Year the police were notified

- Here’s where you put any lienholder, for example, the Bank of Nova Scotia

- Indicate if you have a GST or HST-registered business. If no business then choose “no”

- The business registration number goes here. This only applies to businesses and organizations

- The ratio of the recoverable tax credit portion (typically applies to businesses and organizations) if you

don’t have a business you would not fill this out. - The total amount of damages claimed, less tax

- The total amount of tax claimed

- The deductible amount

- The total amount of damages claimed, including tax but less your deductible

- Who the payment should be issued to? For example, it can be the policyholder or policyholder and a

lienholder - Print your name here

- Location (township or County)where the document is being notarized or witnessed by the Commissioner of

Oaths - The date being signed or notarized (Day and Month)

- Year Proof of Loss signed

- Signature of the Policyholder

- Signature of Notary or Commissioner of Oaths

- Another section for additional insured to sign. For example, if two people were the policyholders, the section

Important things to know about a Proof of Loss Form

Most auto insurance companies in Ontario, fill out most of the Proof of Loss form for you. They will leave the bottom section blank for you to sign and witness if required. However, it’s always a good idea to confirm everything for accuracy, before you sign or have it notarized.

There are also situations when your insurer will send you a blank proof of loss form.

This happens for a few reasons:

- The insurance company is required by law to provide you with a proof of loss form and will send it out to you at the onset of a claim. Why? The insurer wants to avoid not sending it or sending it late, so they supply you with one at the beginning of the claim, whether it is needed or not. This confuses many people as they’re uncertain what to do with the form when received. Most adjusters will advise their claimants that there’s no requirement to complete the form and send it only for regulatory purposes.

- Your insurance company may have been trying to reach you regarding a claim but was unsuccessful, so they mailed a “no contact” letter and a blank Proof of Loss. In this case, the insurance company wants to advise they tried to contact you and also remind you you have a certain timeframe in which to claim or respond to the claim.

- If your insurer denies your claim, you will be presented with a blank Proof of Loss form.

- You decide not to have the damages to your vehicle repaired caused by an accident. Sometimes people choose not to claim damages if the amount of damage is minimal or below their deductible. The insurer will send out a “not claiming” letter advising the policyholder of the timeframe in which to claim should they change their mind.

Insurance companies are required to provide a Poof of loss form within a set time frame

Insurance companies in Ontario are governed by the Insurance Act of Ontario, which specifically states that insurers are required to provide a Proof of Loss form to the policyholder within 60 days of receiving notice to claim. However, insurance companies try and send the form right away so they can satisfy regulatory compliance.

Insurer to furnish forms for proof of loss

Insurance act of ontario

135.(1)An insurer, immediately upon receipt of a request, and in any event not later than sixty days after receipt of notice of loss, shall furnish to the insured or person to whom the insurance money is payable forms upon which to make the proof of loss required under the contract.

Furnishing the Proof of Loss form is not an Admission

Just because an insurance company supplies a Proof of Loss form does not mean that a valid policy is in place, or that coverage exists for a submitted claim. The insurer is required to provide a Proof of Loss form to any potential claimant or insured who notifies the Insurer regarding a loss. If there is no coverage, a letter will be sent to the claimant or policyholder after the Proof of Loss form is submitted, reviewed and subsequently, rejected.